20+ ky payroll calculator

Beranda 20 calculator ky payroll. No monthly service fees.

10 Purchase Invoice Sample Example Format Free Premium Templates

Open an Account Earn 14x the National Average.

. Kentucky Hourly Paycheck Calculator. The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Kentucky State. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

20 ky payroll calculator Minggu 23 Oktober 2022 Edit. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. To estimate a paycheck begin with the total annual salary amount in addition to divide by the particular quantity of pay durations in the year. The state tax year is also 12 months but it differs from state to state.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Free Kentucky Payroll Tax Calculator and KY Tax Rates.

The maximum an employee will pay in 2022 is 911400. This free easy to use payroll calculator will calculate your take home pay. Important note on the salary paycheck calculator.

Ad Compare This Years. Simply enter their federal and state W-4 information as. Kentucky Salary Paycheck Calculator.

Supports hourly salary income and multiple pay frequencies. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. How to calculate annual income.

Easy 247 Online Access. All other pay frequency inputs are assumed to. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Important note on the salary paycheck calculator. So the tax year 2022 will start from July 01 2021 to June 30 2022. Every first Saturday in May.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. For example if an employee earns 1500. Kentucky Payroll Tax Rates.

Some states follow the federal tax year some.

Does A Speeding Ticket Affect Your Insurance Insurance Com

Salary Paycheck Calculator Calculate Net Income Adp

Canadian Payroll Calculator How To Calculate Your Payroll Knit People Small Business Blog

Kentucky Paycheck Calculator Smartasset

Employee Value Proposition The Complete Guide To Building A Great Evp

Kentucky Income Tax Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

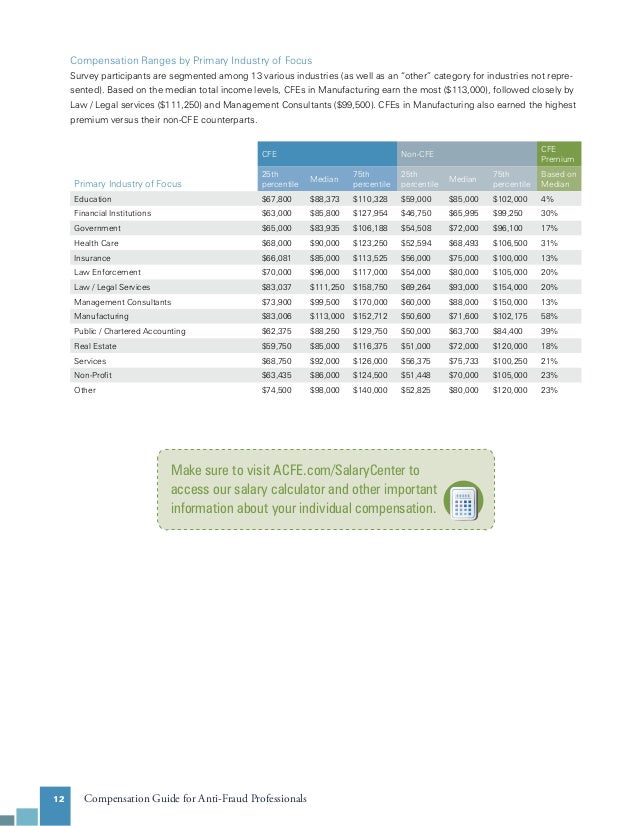

2013 Acfe Compensation Guide

Ac Tonnage Calculator Insert Sq Ft Get Tons Chart

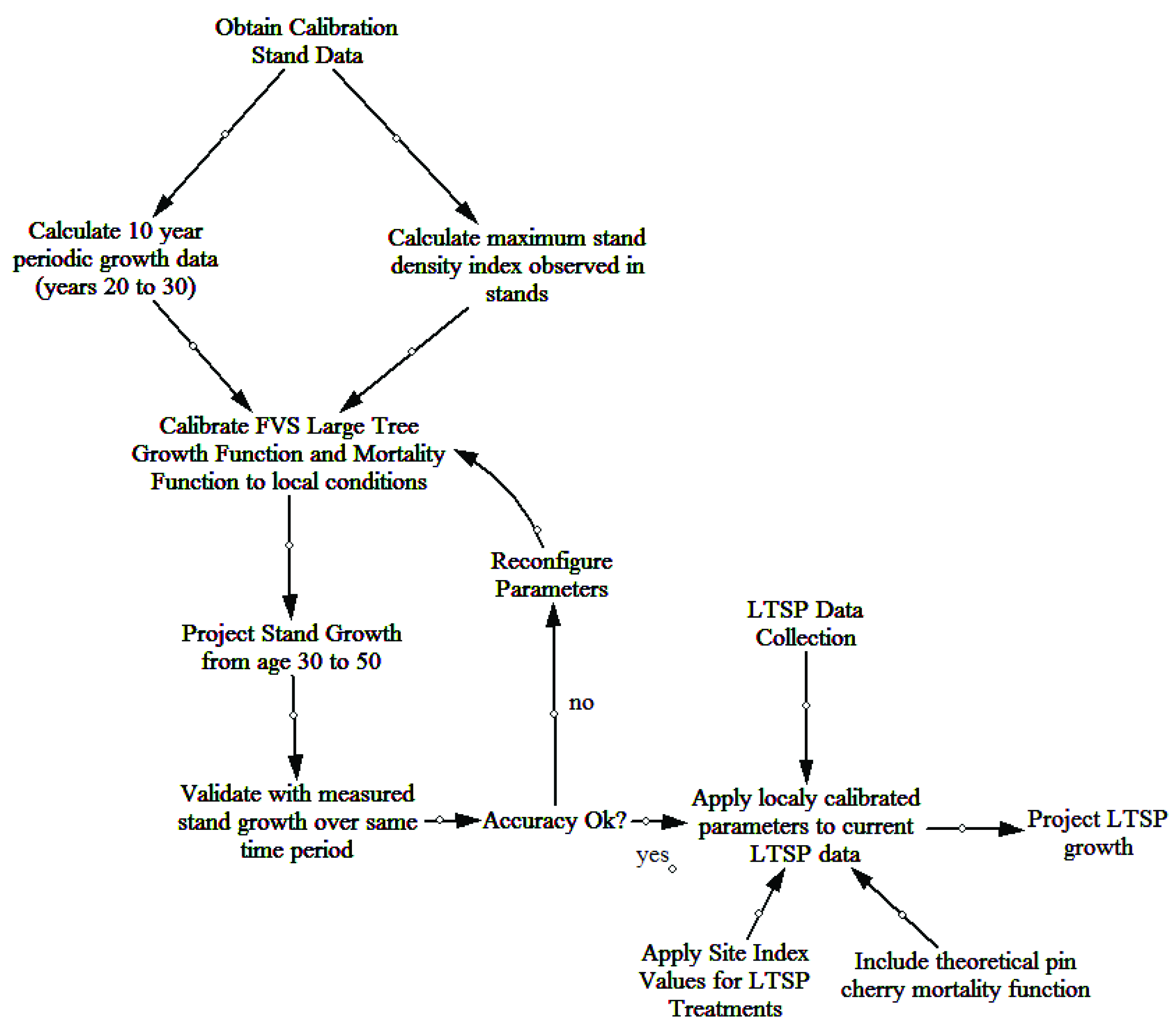

Forests Free Full Text Long Term Projection Of Species Specific Responses To Chronic Additions Of Nitrogen Sulfur And Lime Html

Salary Paycheck Calculator Calculate Net Income Adp

Kentucky Salary Calculator 2022 Icalculator

Financial Calculators Accupay Payroll Salary Hourly Wage

1094 Questions With Answers In Dft Calculations Science Topic

Loiaxi7z1d Vom

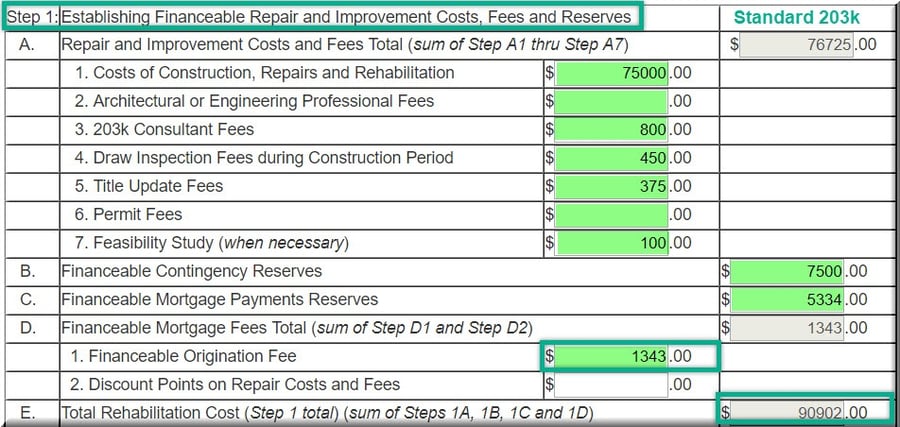

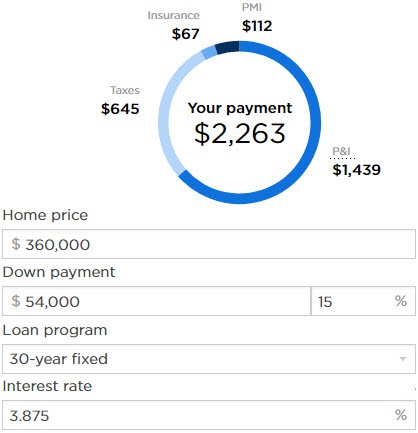

How To Get A Reliable Mortgage Rate Quote In 1 Minute

Salary Paycheck Calculator Calculate Net Income Adp